Over the Next Decade in Michigan, Advanced Energy Tax Credits Will Generate:

$215B New Private Sector Investments

$41.2B New Manufacturing Investments

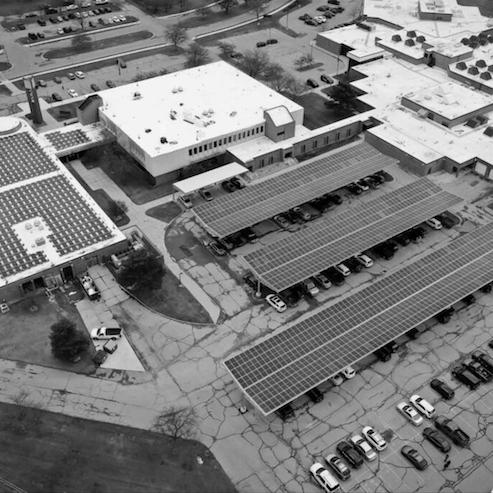

Eaton County Solar

- Status: Operational

- Location: Charlotte, MI (Eaton County)

- Congressional District: Michigan 7th

- Technology: Solar

- Relevant Tax Provision:

- Investment Tax Credit (ITC)

- Fast Fact:

- The Eaton County Solar project is projected to save the county over $6.5 million and reduce energy use by 30% over its lifetime.

- Rooftop and parking lot solar panels have been added to Eaton County’s government complex and coincided with a much-needed roofing upgrade to the main building to prevent leaks and an HVAC upgrade.

Woodland Hills Senior Community Solar

- Status: Operational

- Location: Jackson, MI (Jackson County)

- Congressional District: Michigan 5th

- Technology: Rooftop Solar

- Relevant Tax Provision: Investment Tax Credit (ITC)

- Fast Facts:

- The solar array will generate over 51% of the annual electricity consumption on site.

- The solar production will substantially decrease the community’s annual electric spend.

- This project will have a lifespan of over 30 years, providing long-term protection against rising electricity costs, ensuring sustained financial and benefits for decades to come.

Bollinger Motors

- Status: Operational

- Location: Oak Park, MI; Livonia, MI

- Congressional District: Michigan 11th

- Technology: Electric Work Trucks

- Relevant Tax Provision: Commercial Clean Vehicle Tax Credit (45W)

- Fast Facts:

- The Bollinger B4 has 71% U.S. content, including the battery, motor/axle, and tires.

- The commercial vehicle tax credit has helped catalyze private investment in U.S. manufacturing.

- Bollinger’s investors cited the commercial vehicle tax credit as a significant factor in projecting increased demand for the B4 and derisking investment in Bollinger Motors, a company going toe to toe with Chinese and other foreign companies in the medium duty commercial vehicle space.

- Bollinger Motors grew from 10 employees (founder + current President and COO) in 2018 to nearly 140 employees in 2025.

Southern Clinton County Municipal Authority (SCCMUA)

- Status: In Construction

- Location: Dewitt, MI (Clinton County)

- Congressional District: Michigan 7th

- Technology: Liquid food waste receiving and co-digestion

- Relevant Tax Provision: Investment Tax Credit

- Fast Facts:

- This project is a public-private partnership between SCCMUA and Bioworks Energy.

- The SCCMUA project is expected to receive roughly 10,000 gallons of food waste for processing each day, which will be diverted from landfills, creating significant cost savings.

- This circular process will allow SCCMUA to utilize increased biogas production.

- In total, this project is expected to generate up to 2 megawatt hours annually, reducing the site’s electricity costs by up to 50%.

Michigan DNR Solar

- Status: Operational

- Location: Holland State Park; PJ Hoffmaster State Park; Fort Custer; Allegan County

- Congressional District: Michigan 4th

- Technology: Rooftop Solar, Electric Vehicle Charging

- Relevant Tax Provision:

- Investment Tax Credit

- Transferability

- Energy Communities Bonus Credit

- Fast Facts:

- Michigan Department of Natural Resources has deployed rooftop solar and electric vehicle charging across several state parks using local labor for mechanical and directional boring installations.

- Infrastructure investments to the district totaled roughly $1.5 million in energy producing assets.

- These projects produce roughly 650,000 kilowatt-hours of energy annually, enough to power the park operations in these facilities.

If key advanced energy tax policies are repealed, new analysis indicates that the cost of energy for business, industry, and working families in Michigan will increase nearly 5% by 2026.

46,716

Advanced Energy Jobs in Michigan