Over the Next Decade in California, Advanced Energy Tax Credits Will Generate:

$246B New Private Sector Investments

$95B New Manufacturing Investments

Condor Energy Storage

- Status: Operational

- Location: San Bernadino County, CA

- Congressional District: California 39th

- Technologies: Solar and Storage

- Relevant Tax Provisions:

- Investment Tax Credit (ITC)

- Transferability

- Energy Communities Adder (EC)

- Fast Facts:

- Condor Energy Storage is a 200 MW / 800 MWh solar + storage project powering 150,000 homes in San Bernadino County.

- Over the course of the project’s lifetime, Condor will provide an estimated $25 million in property tax revenue.

- Condor will provide much-needed support to the grid during peak demand using state-of-the-art batteries employing skilled American workers.

Beacon 1 Solar

- Status: Operational

- Location: Mojave, CA (Kern County)

- Congressional District: California 23rd

- Technology: Solar

- Relevant Tax Provision: Investment Tax Credit (ITC)

- Fast Fact:

- Beacon 1 is a 56 MW solar plant in the northwest Mojave Desert. Together, all five Beacon projects supply 250 MW to the Los Angeles Department of Water and Power.

Edwards & Sanborn Solar and Energy Storage Project

- Status: Operational

- Location: Kern County, CA

- Congressional District: California 22nd

- Technologies: Solar and Storage

- Relevant Tax Provision: Investment Tax Credit (ITC)

- Fast Facts:

- The Edwards & Sanborn project has a capacity of 807 MW of solar and 871 MW of storage, enough to power roughly 971,000 homes.

- Together, phases one and two of this project will provide $959 million in private investment.

- This project is located on the Edwards Air Force Base and is the largest public-private collaboration in the history of the U.S. Department of Defense.

Caelux Perovskite Pilot Manufacturing Fab

- Status: Operational

- Location: Baldwin Park, CA

- Congressional District: California 31st

- Technologies: Perovskite Solar Cells

- Relevant Tax Provision:

- Manufacturing Production Tax Credit (45X)

- Domestic Content Adder

- Fast Facts:

- This facility, which manufactures perovskite

solar cells that increase the productivity of

a solar array, is the first of its kind in the

United States.

- The pilot facility currently has the ability to

product 50MWs of capacity, but will double

that capacity by the end of 2025. - To date, the facility has created 65 new,

well-paying manufacturing jobs in the

greater LA area.

- This facility, which manufactures perovskite

Porterville Unified School District’s Advanced Energy Investments

- Status: Operational

- Location: Porterville, CA

- Congressional District: California 22nd

- Technologies: Rooftop solar, battery storage, EV charging

- Relevant Tax Provisions: Direct Pay

- Fast Facts:

- Porterville Unified School District used the Direct Pay provision to install solar, storage, and EV chargers on its facilities. Porterville was able to save $2 million by taking advantage of its Direct Pay eligibility and expects to save up to $3 million over the next ten years.

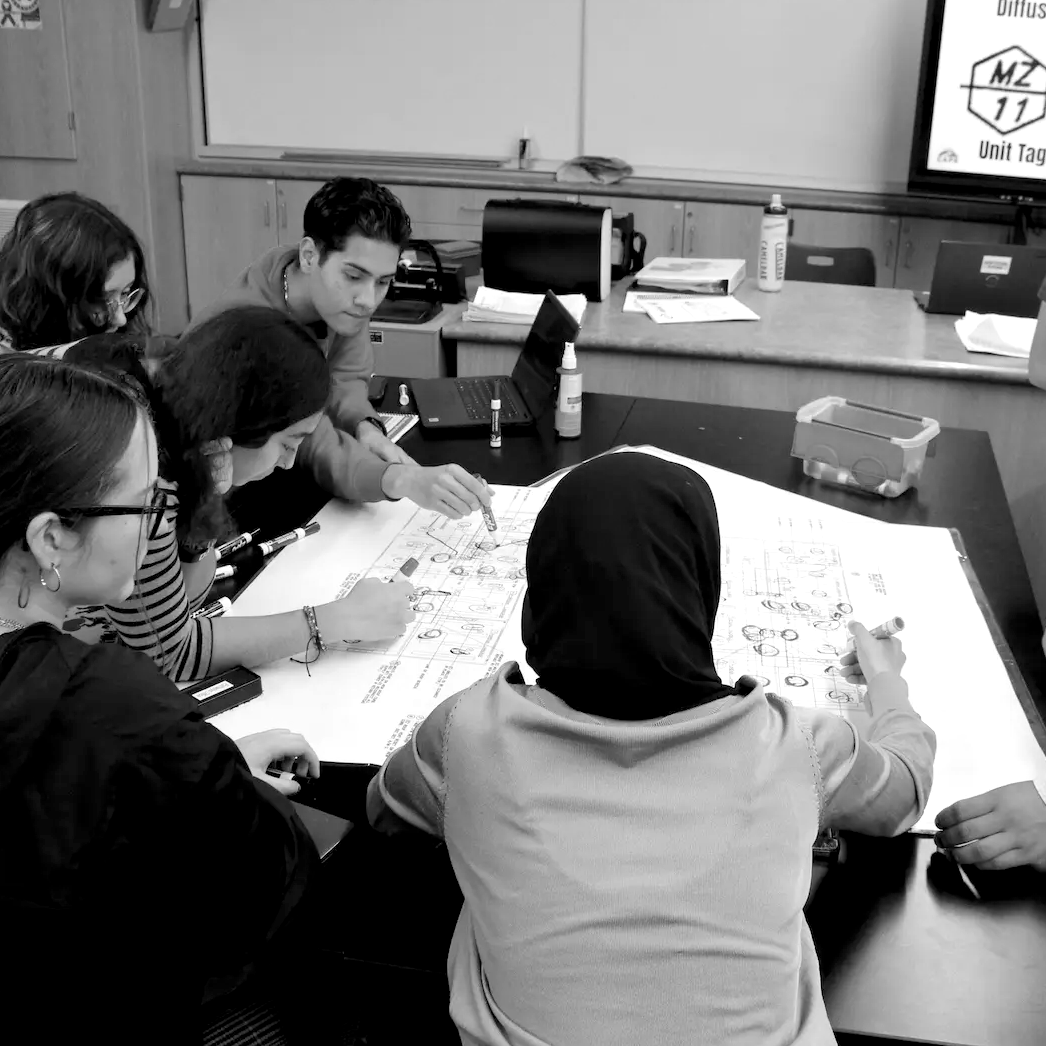

- The installation process has opened up opportunities for students to learn more about energy efficiency and building electrification, teaching them valuable skills in the electrification space.