Aurelius Solar

- Status: Operational

- Location (County / City): Aurelius, NY (Cayuga County)

- Congressional District: New York 24th

- Technology(s): Solar

- Relevant Tax Provision(s):

- Investment Tax Credit (ITC)

- Energy Communities Adder

- Transferability

- Fast Facts:

- Producing 29 megawatts of electricity, this solar farm is the combination of four small-scale adjacent projects. The project provides low-cost electricity to the regional grid and bill credits to thousands of homes and small businesses in the area, helping cut electric bills for subscribers.

- Harnessing transferability, developers were able to unlock greater private capital financing, enabling construction of this project.

- Aurelius Solar was built on remediated land previously contaminated by a power generating facility in the 1960’s. As a result, project developers were able to harness the Energy Communities Adder as a result to help support development.

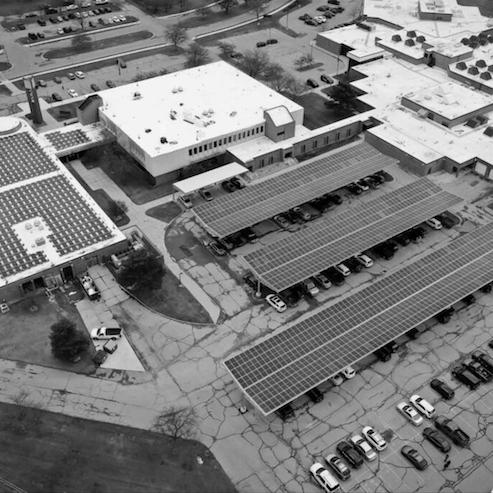

Eaton County Solar

- Status: Operational

- Location: Charlotte, MI (Eaton County)

- Congressional District: Michigan 7th

- Technology: Solar

- Relevant Tax Provision:

- Investment Tax Credit (ITC)

- Direct Pay

- Fast Fact:

- The Eaton County Solar project is projected to save the county over $6.5 million and reduce energy use by 30% over its lifetime.

- Rooftop and parking lot solar panels have been added to Eaton County’s government complex and coincided with a much-needed roofing upgrade to the main building to prevent leaks and an HVAC upgrade.

Woodland Hills Senior Community Solar

- Status: Operational

- Location: Jackson, MI (Jackson County)

- Congressional District: Michigan 5th

- Technology: Rooftop Solar

- Relevant Tax Provision: Investment Tax Credit (ITC)

- Fast Facts:

- The solar array will generate over 51% of the annual electricity consumption on site.

- The solar production will substantially decrease the community’s annual electric spend.

- This project will have a lifespan of over 30 years, providing long-term protection against rising electricity costs, ensuring sustained financial and benefits for decades to come.

Bristol Landfill Solar

- Status: Operational

- Location: Bristol, RI

- Congressional District: Rhode Island 1st

- Technology: Solar

- Relevant Tax Provision: Investment Tax Credit

- Fast Facts:

- Bristol Landfill Solar came online in February 2025, providing 8,700 megawatt-hours of reliable power to a Rhode Island-based company in North Kingstown, RI.

- This is the largest landfill solar project in Rhode Island and used local labor to construct the development.

Southern Clinton County Municipal Authority (SCCMUA)

- Status: In Construction

- Location: Dewitt, MI (Clinton County)

- Congressional District: Michigan 7th

- Technology: Liquid food waste receiving and co-digestion

- Relevant Tax Provision: Investment Tax Credit

- Fast Facts:

- The SCCMUA project is expected to receive roughly 10,000 gallons of food waste for processing each day, which will be diverted from landfills.

This circular process will allow SCCMUA to utilize increased biogas production.

In total, this project is expected to generate up to 2 megawatts of electricity, reducing the site’s electricity costs by up to 50%.

- The SCCMUA project is expected to receive roughly 10,000 gallons of food waste for processing each day, which will be diverted from landfills.

Michigan DNR Solar

- Status: Operational

- Location: Holland State Park; PJ Hoffmaster State Park; Fort Custer; Allegan County

- Congressional District: Michigan 4th

- Technology: Rooftop Solar, Electric Vehicle Charging

- Relevant Tax Provision:

- Investment Tax Credit

- Transferability

- Energy Communities Bonus Credit

- Fast Facts:

- Michigan Department of Natural Resources has deployed rooftop solar and electric vehicle charging across several state parks using local labor for mechanical and directional boring installations.

- Infrastructure investments to the district totaled roughly $1.5 million in energy producing assets.

- These projects produce roughly 650,000 kilowatt-hours of energy annually, enough to power the park operations in these facilities.

Chirichaua Community Health Center

- Status: In Development

- Location: Douglas, AZ (Cochise County)

- Congressional District: Arizona 7th

- Technology: Solar + Storage

- Relevant Tax Provision:

- Investment Tax Credit

- Transferability

- Fast Facts:

- The Chiricahua Community Health Center represents the largest primary care organization in Southeastern Arizona. From their medical, dental, and pharmacy facilities in Douglas, the organization serves roughly one quarter of the entire population of Cochise County.

- Chiricahua has partnered with an advanced energy company to develop a 312-panel solar project that will serve their facilities in Douglas, generating enough electricity annually to power 100% of the Center’s demand. The project likewise includes a 500-kilowatt hour energy storage system.

- By pairing solar and storage, this project will also allow these health facilities to maintain operations even when the grid goes down, as it does frequently. In the first six months of 2024 alone, the grid in Dougals experienced more than ten power outages, with extreme heat and wildfire risk both raising the likelihood of such events and the dangers from them.

- This project will likewise allow the Health Centers to lock in current power prices for the next 20 years, providing valuable economic security in the face of rising costs.

Mammoth Solar

- Status: Operational / In Construction

- Location: Starke & Pulaski Counties

- Congressional District: Indiana 2nd

- Technology: Solar

- Relevant Tax Provisions:

- Investment Tax Credit (ITC)

- Domestic Content adder

- Fast Facts:

- Spanning Starke and Pulaski Counties, Mammoth Solar is one of the largest solar projects in the U.S. When complete, it will generate 1.3 gigawatts of electricity, enough to power 275,000 homes annually. Currently Mammoth North is operational, while South and Central are under construction.

- Sixty-five families lease their land to project developer Doral. When the project is decommissioned, the land will be returned to the families to use as they see fit.

- Roughly 2,500 sheep, donkeys, alpacas, and Kunekune pigs graze daily underneath the array at Mammoth North, a practice known as agrivoltaics that helps both support local farming while managing vegetation.

- Solar technology and racking for the project have been sourced from production facilities in America, including steel from Indiana mills.

Form Factory 1

- Status: Operational

- Location: Weirton, WV (Hancock County); Near Pennsylvania and Ohio Borders

- Congressional District: West Virginia 2nd

- Technologies: Energy Storage

- Relevant Tax Provisions:

- Investment Tax Credit (ITC)

- Transferability

- Energy Communities Adder (EC)

- Fast Facts:

- Factory 1 is the manufacturing hub for Form’s long-duration iron air energy storage systems. These storage systems are designed to store and discharge electricity for 100 hours, long enough to cover the typical outage after a hurricane, wildfire, or other extreme weather event.

- Form Factory 1, which is situated at the historic site of the former Weirton Steel Mill, represents an investment of nearly $800 million in public and private capital.

- The 550,000-square-foot factory currently employs 300 people with family-sustaining manufacturing jobs. By 2028, Factory 1 is set to nearly double in size, supporting more than 750 employees.

Matrix Development Group

- Project Name: Matrix Development Group

- Status: Operational

- Location: Staten Island, NY (Suffolk County)

- Congressional District: New York 11th

- Technology(s): Rooftop solar

- Relevant Tax Provisions:

- Investment Tax Credit (ITC)

- Fast Facts:

- Matrix Development Group invested in rooftop solar at its distribution center in Staten Island, NY.

- This 5,141-kilowatt community solar system serves New York residents and the facility created hundreds of logistics jobs in Staten Island.

- In total, over $10 million went into project development and benefits have ranged from energy savings, job creation, and even new client and employee opportunities.

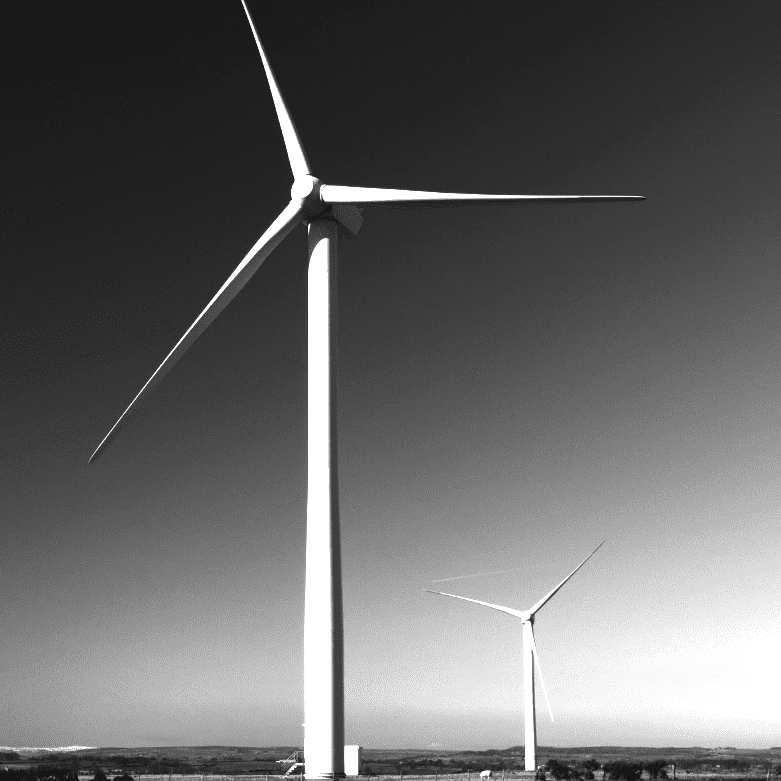

High Banks Wind

Status: Operational

Location: Bellevue, KS (Republic County)

Congressional District: Kansas 1st

Technology: Wind

Relevant Tax Provision: Investment Tax Credit

Fast Facts:

- High Banks Wind is an operational wind farm developed by NextEra Energy. High Banks provides over 600 megawatts of power and is the largest single source of energy in the State of Kansas, according to the University of Kansas.

- Over 450 construction jobs were created for this project, with an average salary of $116,701 per employee. In total, the project is expected to create 726 jobs and an annual payment of $5 million to landowners.

- At full capacity, High Banks will generate enough electricity to power more than 240,000 homes.

Target Corporation – Store T2197

- Status: Operational

- Location: Westminster, CO (Adams County)

- Congressional Districts: Colorado 4th

- Technology: Rooftop solar

- Relevant Tax Provision: Investment Tax Credit (ITC)

- Fast Facts:

- Target invested in a 497-kilowatt rooftop solar system, developed by Powerflex, which has saved them roughly $40,000 per year.

- Over the course of project’s construction, it created roughly 15 jobs.